The Problem

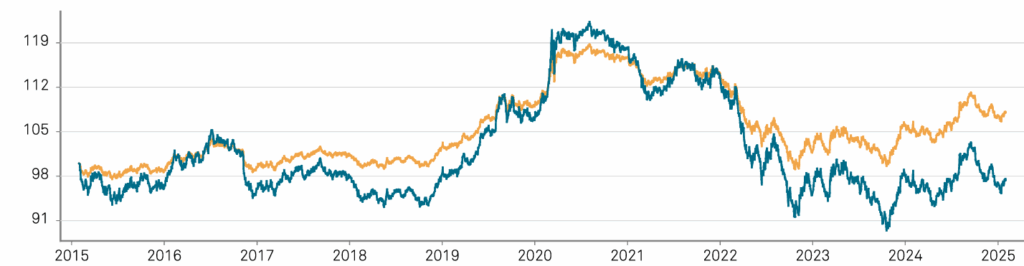

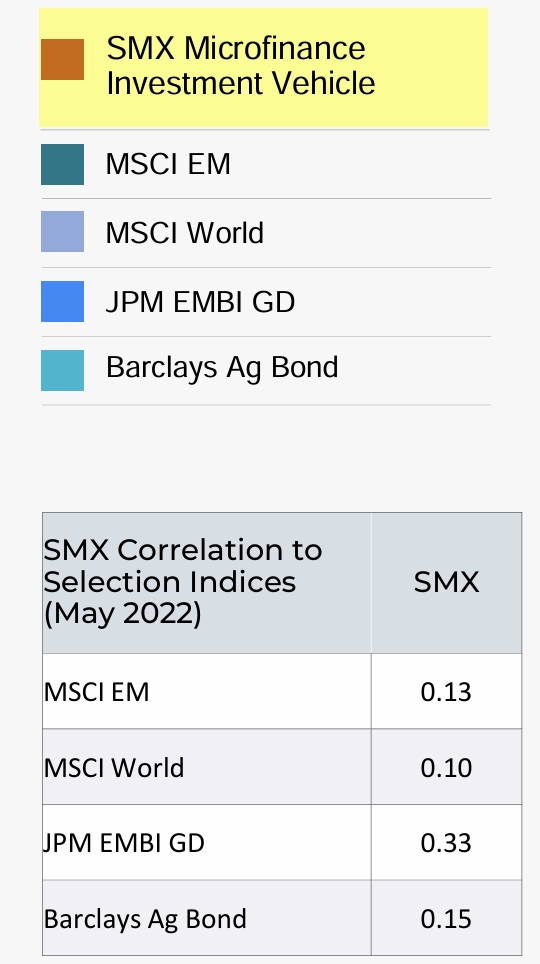

Achieving the perfect portfolio mix has been the ultimate goal for most folks who are working towards retiring some day. Balancing the right amount of risk vs. reward can be a real challenge. Over the past decade, the conservative portion of an investors portfolio has underperformed. This is because of underperforming bonds. The growth side of portfolio’s namely stocks can be quite volatile. Access to alternative investments, such as the micro lending space, has been all but impossible for individual investors to invest in. This has been unfortunate because the micro lending sector has outperformed bonds with both better returns and less risk. We have opened up this investment space to the public.

0.19%

10 YR RETURN

Annualized

The Solution

The Micro Lending asset class is the solution. We hate using fancy words and phrases, but we are going to throw one out that you should learn about. The phrase is “Asymmetrical Risk.” That’s a fancy way of saying low risk but high reward. This is the holy grail of all portfolio construction. The Micro Lending asset class has high demand and consistent returns, year after year. Even better, history shows us that the micro lending space is consistent, even when the stock and bond markets are volatile.

Our Track Record

12

Micro lending portfolios successfully built and serviced to maturity from 2006 to present. Each portfolio has been profitable.

100

Over 100 million dollars in portfolio value, which generated millions in profits.

32

Through our proprietary filtering strategies, we have achieved a 32% lower default rate than our competition.

72

Years of combined industry experience. We are one of the most experienced micro lending businesses in the Western United States.

144

Adam raised and managed over 144 million dollars in assets for families across Northern Utah during his 18 year career.

0

Of our lending portfolios have been unprofitable.

Opportunity Knocks

Our business model has been vetted and improved over the years. You could say it is tried, true, and impressive. After 2 decades of running these portfolios privately, we have decided to open this opportunity up to the public.

Our lending approach has made millions in profits over the last couple of decades. Don’t miss out on a chance to diversify your portfolio by investing in a hard-to-get asset class that offers strong returns with minimal volatility. This will be our 13th portfolio build out. The last 12 have all made good money. We are adding 2 million of our own assets to this next portfolio.

This is a great alternative to the disappointing bonds and fixed income investments in your portfolio. Consider replacing them with our product and get the same return in less than half the time.

Fund Terms

Minimum commitment:

$100,000

Management fee:

2%

Term:

Minimum 1 or 2 years.

Fund Payout:

Paid Semi-Annual. 60 day incubation.

Offering opens:

August 15, 2025.

Offering closes:

December 15, 2025.

Share Classes:

A. 100k-499k-12% pref. This is a one-year principle tie up.

B. 500k plus- 14% pref. This is a one-year principle tie up.

C. 100k-499k- 18% pref. This is a two-year principle tie up.

D. 500k plus- 22% pref. This is a two-year principle tie up.